2025 Mileage Reimbursement Rate Ontario Ca. — the general prescribed rate used to determine the taxable benefit of employees relating to the personal portion of automobile expenses paid by their employers will remain at. Medical or moving purposes (eligible only for specific taxpayers):

— the general prescribed rate used to determine the taxable benefit of employees relating to the personal portion of automobile expenses paid by their employers will remain at. What is the cra reasonable allowance for mileage rates for 2025/2025?

2025 Mileage Reimbursement Rate Ontario Barb Johnna, Here’s the cra’s automobile allowance rates for the past five years:

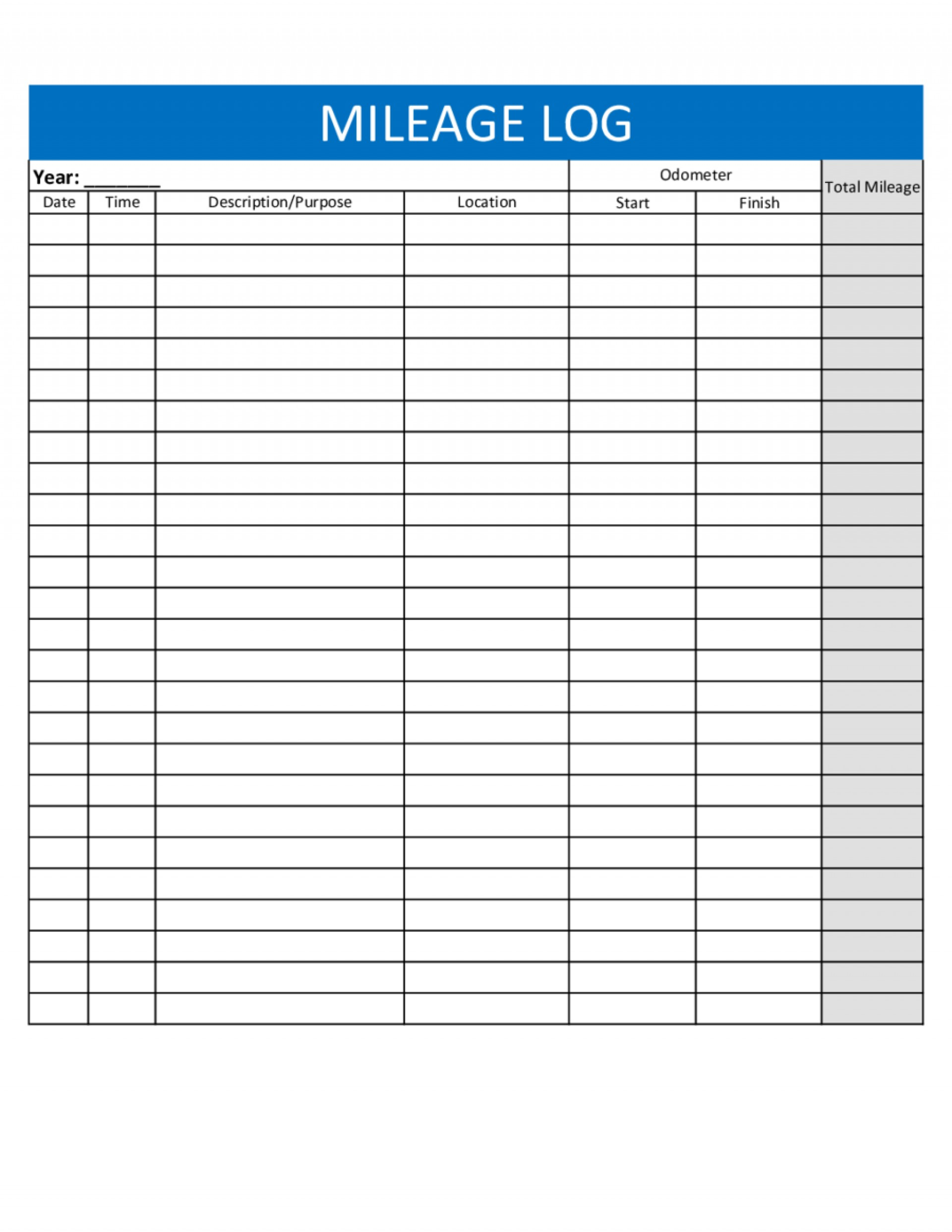

Ontario Mileage Reimbursement Rate 2025 Joy Sonnie, The kilometric rates (payable in cents per kilometre) below are payable in canadian funds only.

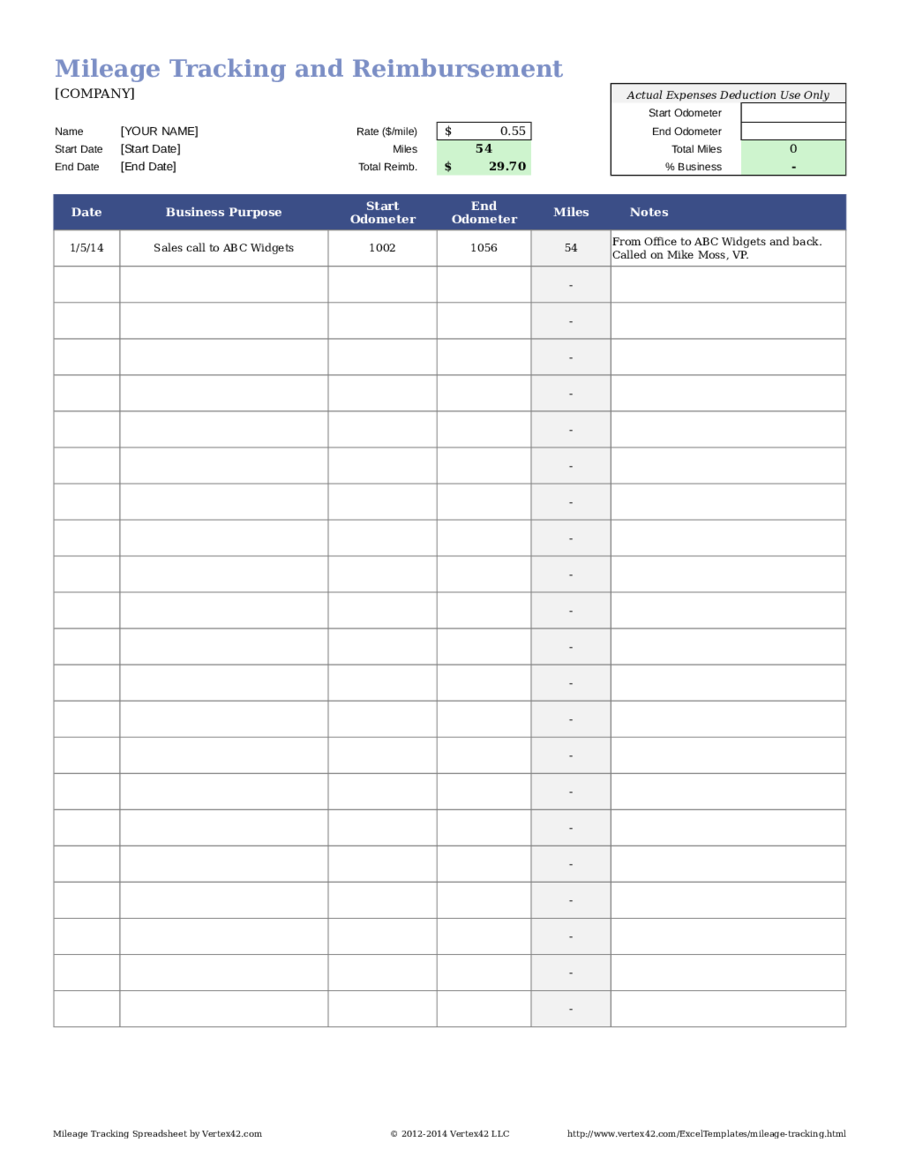

2025 Mileage Reimbursement Rate Form Debby Brittani, Here’s a breakdown of the recent revisions:

Ontario Mileage Rates 2025 Alicia Cornelle, — to be reimbursed, your expenses must be admissible according to the passport guidelines that were in effect on the date you received the goods and services.

2025 Mileage Rate Ontario Carry Crystal, You can find upcoming cpi release dates on our schedule page.

Mileage Rate 2025 Ontario Alia Phyllis, Medical or moving purposes (eligible only for specific taxpayers):

2025 Mileage Reimbursement Rate Ontario Allene Willamina, Here’s a breakdown of the recent revisions:

2025 Mileage Reimbursement Rate Ontario Shay Yelena, What is the cra reasonable allowance for mileage rates for 2025/2025?

2025 Mileage Rate Ontario Carry Crystal, — to be reimbursed, your expenses must be admissible according to the passport guidelines that were in effect on the date you received the goods and services.

Mileage Reimbursement Canada 2025 Jade Rianon, Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses.