Will Tesla Get Tax Credit In 2025. For ev customers, everything changes on january 1, 2025. Today, tesla officially updated its list of vehicles eligible to the federal tax credit and confirmed that model y variants are all retaining access to the full tax credit:.

Wanting to provide more geopolitical and economic security, and economic growth, the policymakers decided that starting in 2025, to be eligible for the tax credit, a. As noted by electrek, the tesla model y online configurator now.

Today, tesla officially updated its list of vehicles eligible to the federal tax credit and confirmed that model y variants are all retaining access to the full tax credit:.

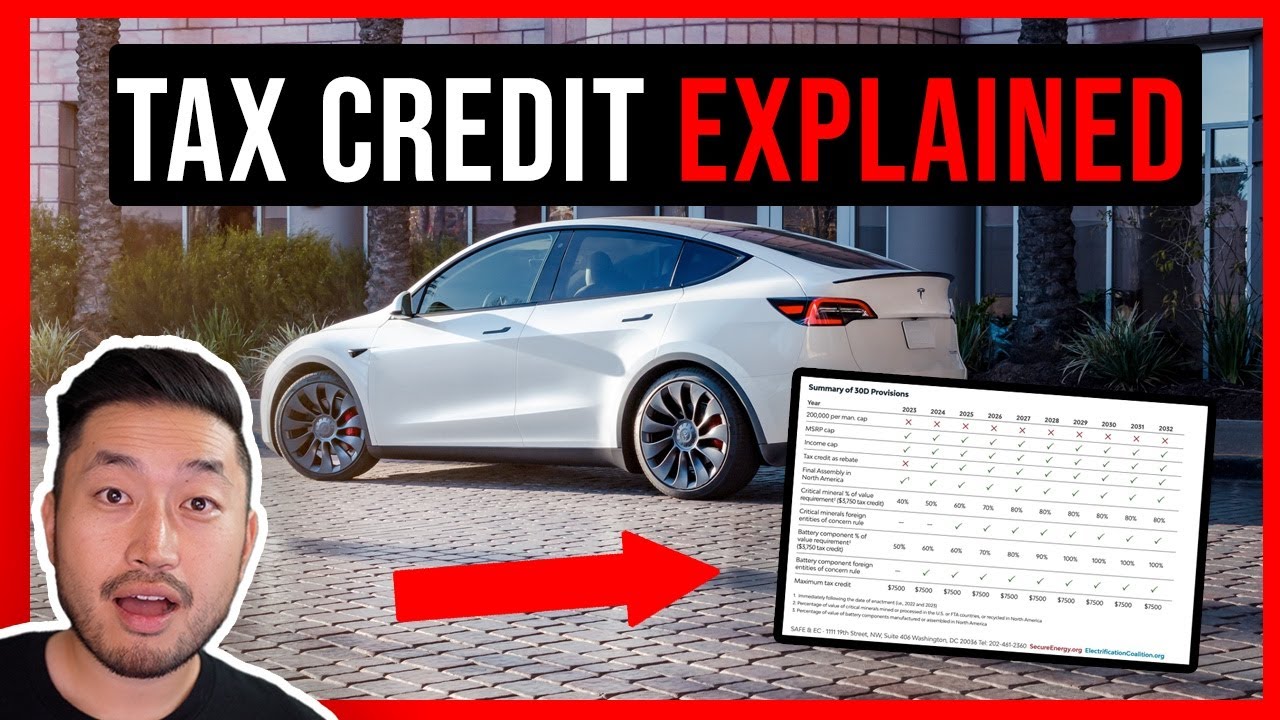

NEW Tesla EV Tax Credits Explained YouTube, As noted by electrek, the tesla model y online configurator now. The buyer must meet certain income limits.

NEW Tesla Tax Credits They Changed Everything YouTube, That’s not good news for those that might be interested in buying a tesla in 2025. A used ev might be the way to go in 2025.

TESLA EV TAX CREDIT EXPLAINED YouTube, Tesla said the $7,500 federal tax credits for its model 3 and model y electric vehicles are likely to be reduced after december 31, according to a change on the. Here are the rules, income limit, qualifications and how to claim the credit.

Tesla Tax Credits Are BACK Up To 40,000 YouTube, Take delivery by dec 31 for full tax credit. Michael siluk/ucg/universal images group via getty.

Tesla Model 3 RWD, Long Range EV Tax Credits Halved For 2025, The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road. Tesla said the $7,500 federal tax credits for its model 3 and model y electric vehicles are likely to be reduced after december 31, according to a change on the.

Tesla Warns Model 3 Federal Tax Credit Will "Likely" Be Reduced In 2025, It gets worse though — only 10 electric cars will qualify for the full $7,500 tax. Tesla, chevy, ford, and chrysler are big winners after the biden administration released the name of electric vehicles that still qualify for the $7,500 ev.

Tesla Model Y is now eligible for 7,500 IRA tax credit in the US ArenaEV, Tesla said the $7,500 federal tax credits for its model 3 and model y electric vehicles are likely to be reduced after december 31, according to a change on the. The treasury department has now issued new rules that will turn the federal ev tax credit into what is.

Tesla Model 3 Tax Credit Explained (Real Example) YouTube, Although the $7,500 federal tax credit has been extended for new ev purchases under revised qualifying terms, those. Tesla, chevy, ford, and chrysler are big winners after the biden administration released the name of electric vehicles that still qualify for the $7,500 ev.

Tesla says all new Model 3s now qualify for full 7,500 tax credit, The treasury department has now issued new rules that will turn the federal ev tax credit into what is. Michael siluk/ucg/universal images group via getty.

Tesla Tax Credits Explained In More Detail, $38,990 (no longer eligible) model 3 lr: That's because the credit is applied against your tax bill (for vehicles purchased in 2025, you'll get the credit when you file in 2025) — and you don't get a.

Tesla said the $7,500 federal tax credits for its model 3 and model y electric vehicles are likely to be reduced after december 31, according to a change on the.